Wallenius Wilhelmsen announces another solid quarter

Wallenius Wilhelmsen reported strong performance for the first quarter of 2024 with EBITDA at USD 438m and a net profit of USD 185m.

“We are very pleased with our results in Q1 2024, in particular in view of the impacts from multiple, external events. Shipping volumes and available capacity were negatively impacted by the rerouting away from the Red Sea. In addition, the bridge collapse in Baltimore impacted operations on the US east coast. Despite this, and thanks to our teams' extraordinary efforts, we delivered another strong quarter,” says Lasse Kristoffersen, President, and CEO at Wallenius Wilhelmsen.

The first quarter of 2024 reflected continued high activity and profitability across all segments, despite geopolitical and operational challenges. Q1 EBITDA was USD 438m, of which shipping delivered USD 366m, logistics USD 46m and government USD 34m.

Increased demand for integrated services

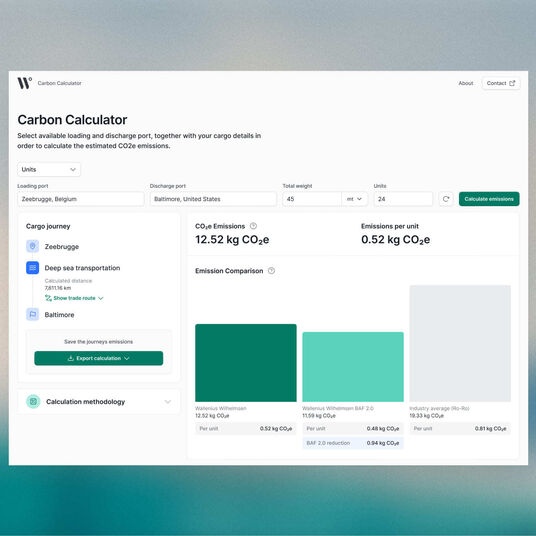

With capacity constraints ongoing, many customers are increasingly looking to secure integrated shipping and logistics solutions ahead of scheduled contract renewals. “In 2024, a substantial portion of our contracts are due for renewal. Scarcity of shipping capacity provides a firm backdrop for negotiations and business activity. We see increased demand for logistics and integrated services, and support for the ambition to reduce emissions,” says Kristoffersen.

Delivering on CO2 intensity targets and setting new goals

Wallenius Wilhelmsen met the CO2 intensity target set for 2023, enshrined in the sustainability-linked financing framework established in 2022, and is actively committing to new net zero goals. “We have upped our ambitions on decarbonization with a goal of reducing our emissions by 40% by 2030 (compared to 2022) and becoming net zero by 2040,” says Kristoffersen.

During the quarter Wallenius Wilhelmsen also ordered four additional Shaper Class methanol dual fuel vessels, for a total of eight firm orders. Further, the company utilizes various energy efficiency measures and vessel upgrades to further reduce the fleet’s emissions. The newbuilds and energy efficiency initiatives are key elements in the company’s journey towards net zero.

Despite the financial implications of external events, the company expects 2024 to be another strong year, somewhat better than 2023.

Q1 2024 highlights

- Delivers a Q1 EBITDA of USD 438m, with strong contributions from all segments despite the effect of external events in the Red Sea and Baltimore. Shipping delivers EBITDA of USD 366m (adj. for sales gain), logistics USD 46m and government USD 34m

- Sees strong customer demand and improved contract terms with net rates improving 5% QoQ and 8% YoY. The H&H share ended at 25% for the quarter

- Orders four 9,300 CEU vessels, bringing newbuilding count to a total of eight vessels

- Commits to updated net zero target and delivers on 2023 sustainability goals

- Maintains expectation that 2024 is likely to be another strong year, somewhat better than 2023, despite the financial implications of external events